NORTH AMERICA: Canadian National has unveiled a rival bid to acquire Kansas City Southern, insisting to investors that its offer presented to the KCS directors on April 20 would be ‘superior’ to the proposed merger between KCS and Canadian Pacific announced on March 21.

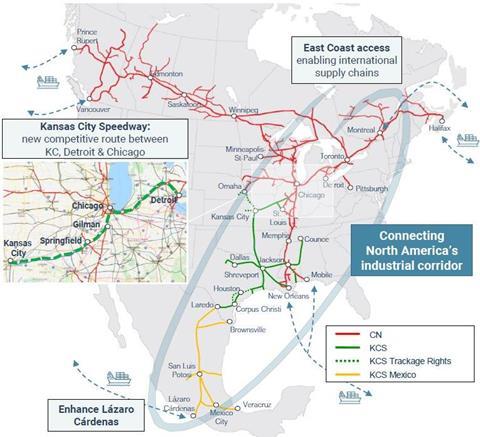

According to CN, the combination of its 31 000 km network with the 9 000 km operated by KCS would ‘create the premier railway for the 21st century, connecting ports in the United States, Canada and Mexico, providing superior service, enhanced competition and new market access to move goods across North America efficiently and safely’.

CN ‘is ideally positioned to combine with KCS to create a company with broader reach and greater scale, and to seamlessly connect more customers to rail hubs and ports in the USA, Mexico and Canada’, explained President & CEO Jean-Jacques Ruest when the bid was announced.

‘CN and KCS have highly complementary networks with limited overlap that will enable them to accelerate growth in single-owner, single-operator, end-to-end service across North America. With safer service and better fuel efficiency on key routes from Mexico through the heartland of America, the result will be a safer, faster, cleaner and stronger railway.’

Cash and stock offer

CN says its cash-and-stock offer represents a 21% premium over the implied value of the CP transaction, giving the smaller railroad an enterprise value of US$33·7bn. KCS shareholders would receive US$200 in cash and 1·059 shares of CN common stock for each KCS common share. Based on the April 19 closing price, this values the offer at US$325 per KCS share, ‘an implied premium of 45% when compared to KCS’s unaffected closing stock price on March 19’.

CN has engaged JP Morgan and RBC Capital Markets as financial advisors, and told the KCS directors that it had finalised US$19·3bn of financing commitments to support the offer, meaning that it was not dependent on obtaining shareholder approval.

CN believes that its greater cash consideration would deliver ‘greater value and certainty to KCS shareholders, as well as participation in the significant upside of the combined company’. Using what it describes as ‘conservative estimates based on publicly available information’, CN estimates that the combination would result in EBITDA synergies approaching US$1bn a year, with the vast majority coming from additional revenue opportunities.

CN anticipates that the transaction would be accretive to its adjusted diluted earnings per share in the first full year after it assumed control of KCS, excluding incremental transaction-related amortisation. The combination is then expected ‘to generate double-digit accretion upon the full realisation of synergies thereafter’.

Voting trust envisaged

As with the CP merger agreement, CN envisages that KCS would be placed in trust pending the completion of any regulatory investigation into the proposed combination. Whereas CP and KCS connect end-on at Kansas City, there is a greater potential overlap between the smaller railway and CN’s former Illinois Central network acquired in the 1990s.

Subject to obtaining approval from KCS shareholders, CN envisages that the railway would be placed into a voting trust during the second half of 2021, pending approval of the merger by the US Surface Transportation Board and the Mexican regulatory authorities. Once that had been received, CN would look to take full control in the second half of 2022.

CN has also offered to invite four of the KCS board members to join the CN board ‘at the appropriate time’, and proposed that Kansas City should become the headquarters of the combined group’s US operations. However, some analysts have suggested that the higher proportion of cash in the CN offer would leave KCS shareholders with less influence over the combined company than would be the case with the CP merger.

‘We firmly believe our proposal is far superior to KCS’s existing agreement with CP because it offers superior financial value over the immediate and long-term, a more complementary strategic fit, greater choice and efficiencies for customers and enhanced benefits for employees and local communities’, added CN Chairman Robert Pace. ‘We look forward to engaging constructively with KCS’s board and all relevant stakeholders to deliver this superior transaction.’

KCS confirmed later in the day that it had received CN’s unsolicited proposal, and emphasised that its board of directors would evaluate the offer ‘in accordance with the terms of KCS’ merger agreement with CP’. The railway would ‘respond in due course’, but it noted that ’the KCS board of directors has not made any determination with respect to CN’s proposal at this time’.