USA: Canadian National’s US$33·6bn bid to acquire Kansas City Southern received a major setback on August 31, when the federal Surface Transportation Board rejected an application to use a voting trust as part of the process.

Announcing the unanimous decision of the five-strong board, STB said that it had ‘determined that the proposed voting trust is not consistent with the public interest standard under the board’s merger regulations’.

The deal agreed between the two railroads’ boards in June envisaged that CN would purchase KCS using a mix of cash and shares. To expedite the process and allow the KCS shareholders to obtain their payment as soon as possible, the railroads proposed that KCS should be placed under the control of a voting trust during the regulatory approval process.

The smaller railroad would continue to be run by its existing management to ensure its independence. In the event that the merger were to be rejected by any of the regulatory authorities, the independent trustee would be instructed to divest KCS under STB oversight.

Citing potential competition concerns, STB determined that the CN merger should be assessed under its amended rules introduced in 2001, which include a strong public interest factor and suggest that voting trusts should be the exception, rather than the rule.

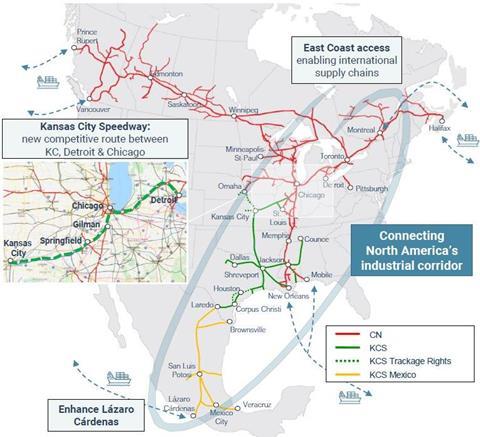

Given its relative size, KCS had been offered a waiver from the 2001 rules. This waiver would have applied to a US$25bn end-to-end-merger with Canadian Pacific announced in March, which was subsequently dropped in favour of the CN bid. STB had confirmed in May that CP would have been able to use a voting trust to facilitate that transaction. Although CP submitted an improved US$31bn offer on August 10, this was rejected by KCS as not being a ‘superior proposal’ to the CN deal.

KCS shareholders are due to vote on September 3 whether to accept the CN offer. That meeting had been scheduled for August 19, but was delayed pending the STB ruling on the voting trust application.

Some of CN’s largest shareholders are now demanding that the railroad abandon its merger attempt, with at least one hedge fund manager reportedly calling for the resignation of CN’s Chairman Robert Pace and CEO Jean-Jacques Ruest. ‘CN should immediately withdraw from its agreement to buy KCS’, TCI’s Chris Hohn told the Financial Times. ‘The CN board should not proceed without a voting trust because it would be hugely value destructive, cost billions in break fees and would distract management at a time when the business is underperforming.’

CP offer still open

Welcoming the STB decision as ‘the right one for rail shippers, the freight rail industry and the North American economy’, CP noted that ‘hundreds of rail shippers, community leaders, elected officials and other stakeholders’ had voiced public interest concerns over the CN merger proposal. CP reiterated that it was continuing to pursue its application to acquire KCS, which it believes would be the only viable consolidation between any of the seven Class I railroads. The railroad recommended that KCS shareholders should vote against the CN deal at the meeting on September 3.

‘The STB decision clearly shows that the CN-KCS merger proposal is illusory and not achievable’, said CP President & CEO Keith Creel. ‘Knowing this, we believe the August 10 CP offer to combine with KCS, which recognises the premium value of KCS while providing regulatory certainty, ought to be deemed a superior proposal. Today, we have notified the KCS Board of Directors that our August 10 offer still stands to bring this once-in-a lifetime partnership together.’

- Read more about STB and the CN-KCS merger application in the September 2021 issue of Railway Gazette International magazine.