UK: Better usage insights and the ability to link concessionary fare entitlements to contactless bank cards are to be offered through a partnership between payments processing company Littlepay and ticketing, journey planning and passenger information platform provider UrbanThings.

A unique ‘payment token’ will be generated using cardholder data received at point of tap-in, but tokenised to protect the cardholder’s identity. This will provide users of UrbanThings’ UrbanHub back office with insights into passenger behaviour across multi-modal transport networks, enabling operators to better understand travel patterns and optimise their services.

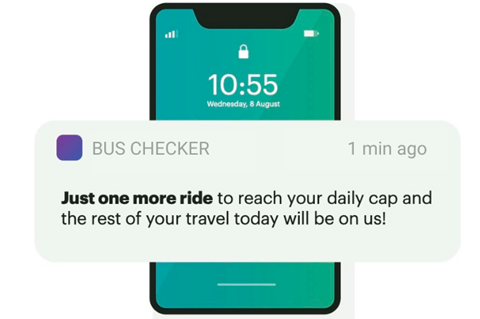

The technology also offers a ‘buy now, tap later’ payment option, whereby mobile app users are able to associate their contactless bank card with a transport account. All prepaid journeys, subscriptions, discounts and concessionary entitlements can be linked to a bank card, which can then be used as the authority to travel.

Littlepay said the use of bank cards offers transport authorities the possibility of phasing out their dedicated smart cards, eliminating the cost of issuing plastic cards and maintaining a closed loop infrastructure.

‘For the growing numbers of passengers that regularly use tap-to-pay on transit, it will be a game-changer to be able to access mobility-as-a-service benefits without changing their payments behaviour’, the company explained. ‘They can use what they already carry in their pocket, their contactless bank card or mobile wallet, for all their ticketing needs.’